Tax

HB 360 Brings Welcome Changes to Affordable Housing Tax Law in Kentucky

The new formula for calculating property tax on multifamily affordable housing is designed to level the playing field in Kentucky.

Indiana Enacts PTE Tax Legislation, and Kentucky Isn’t Far Behind

New PTE legislation in both Kentucky and Indiana could have a significant (and potentially positive) impact on 2022 tax filings.

Secure 2.0 Act of 2022 Introduces Key Changes for Workplace Retirement Plans

Employers that currently maintain a qualified retirement plan or are evaluating a future plan should consider implementing the new federal rules.

For Employee Benefit Plans: 2022 Year-End Planning Checklist

As we come to the end of 2022, here are some key tax planning and compliance topics to consider for employee benefits plans.

For Individuals: 2022 Year-End Tax Planning Checklist

As we approach year end, now is the time to identify opportunities for reducing, deferring or accelerating your tax obligations. Click for a federal tax planning checklist to use as a guide.

IRS issues 2022-2023 Special Per Diem Rates

As of Oct. 1, the IRS has raised the special per diem rates to substantiate ordinary and necessary business travel expenses away from home.

Inflation Reduction Act Doubles R&D Credit Payroll Tax Offset for Qualified Small Businesses

The R&D credit offset of payroll tax liability is often overlooked by small businesses, but it can be a great opportunity for some taxpayers.

Inflation Reduction Act Brings Changes to Tax Provisions

The Inflation Reduction Act of 2022 includes new corporate tax provisions .

4 Tips for Working With a Short-Staffed IRS

From long call wait times to tax return processing errors and delays, the IRS staffing shortage is having a big impact on taxpayers.

2021 Lease Audit: Make Sure Your Business is Prepared

After the rollercoaster of past two years, every business should take advantage of a lease audit to evaluate their real estate portfolio.

Bill Ushers in New Tax Amnesty Program, Other Changes

Kentucky HB 8 enacts a short-term tax amnesty program set to begin in October, and expands the list of services required to pay sales and use tax.

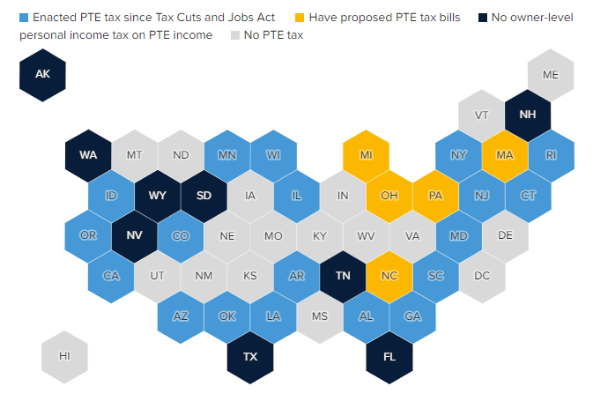

Pass-Through Entities – State Tax Elections Pros & Cons

More than 20 states now allow pass-through entities (PTEs) to elect to be taxed at the entity level to help residents avoid the $10,000 limit on federal itemized deductions for state and local taxes, also known as the “SALT cap.”

Pooled Employer Plans: From the SECURE Act To Today

Pooled Employer Plans (PEPs) were created to expand access to retirement benefits by addressing some of the restrictions and perceived drawbacks of multiple employer plans (MEPs) while creating additional benefits for PEP participants, such as tax credits and the “one bad apple” rule.

2022 Tax Outlook Survey

The 2022 BDO Tax Outlook Survey polled 150 middle market tax executives to find out more about the challenges they are facing, their outlook on the rapidly evolving global tax landscape and how they are planning to adapt to uncertainty in the upcoming year.

Professional Services M&A – How Can Firms Capitalize On Current Opportunities?

Professional services M&A activity is at a fever pitch. What are the drivers – and impacts – of increased M&A activity and the unique factors that make advertising, architecture and legal firms such attractive targets?

BBB Is In The Rear-View Mirror; Next Up – Tax Extenders

While all signs point to the fact that, given the current makeup of the House and Senate, the Build Back Better bill on the table last fall is essentially lifeless, some of the policies contained in the bill may be back in play in 2022.

Significant Change To The Treatment of R&E Expenditure Under Section 174 Now In Effect

As 2022 kicks off and tax legislation continues to be stalled in Congress, the amendment to Internal Revenue Code (IRC) Section 174 originally introduced by the 2017 Tax Cuts and Jobs Act (TCJA) is now in effect.

Inflation Is Here – What Now?

Many economists, business leaders and investors agree that some of the inflationary pressures being felt are temporary and normal for a recovering economy. Nevertheless, a proactive approach is advisable.

Treasury, IRS Release Final LIBOR Transition Regulations

Final LIBOR transition regulations provide much needed guidance to those required to modify existing contracts to address the elimination of IBORs.