Tax

Pass-Through Entities – State Tax Elections Pros & Cons

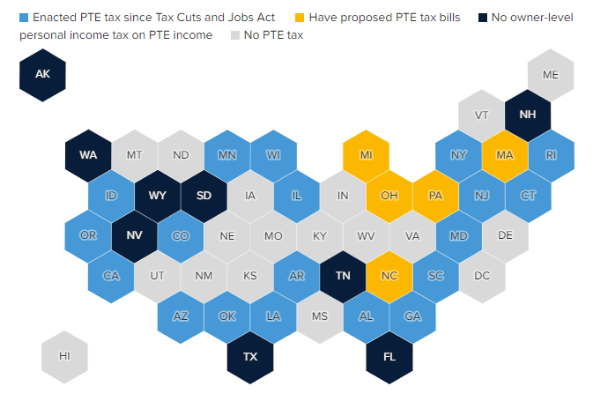

More than 20 states now allow pass-through entities (PTEs) to elect to be taxed at the entity level to help residents avoid the $10,000 limit on federal itemized deductions for state and local taxes, also known as the “SALT cap.”